GTS Yield Token — Lightpaper

“The first DAO balance sheet that bridges Bitcoin, Ethereum, and Dubai real estate into one yield-generating treasury.” Powered by the Signalhaus trading strategy.

⚡ Signalhaus Edge

Institutional-grade BTC/ETH trading intelligence.

🔗 Dual-Economy

Crypto yield today, tokenized Dubai real estate tomorrow.

🛡️ Transparency

Multisig custody, live feeds, weekly NAV.

The Problem

- Single-asset, no-yield strategies underutilize capital.

- DAOs lack disciplined treasury management.

- Investors want simple access to crypto + real-asset yield.

The GTS Solution

- Trading Engine: Signalhaus BTC/ETH cycle-aware allocation.

- Yield Mix: Staking, LPs, lending, strategic trading.

- RWA Arm (Dubai): Regulated, tokenized rental yield.

- Proof-First: Multisig custody, weekly NAV reporting.

Performance Snapshot

Signalhaus strategy results — disciplined trading that compounds NAV.

📊 BTC Case Study

$100k → $168k in 12 months.

⚡ Consistency

Sharpe ratio 2.1 vs BTC’s 1.0.

🔐 Discipline

Risk-managed entries, cutting losses, compounding winners.

What is GTS?

GTS is a tokenized, performance-driven treasury blending digital and real economies.

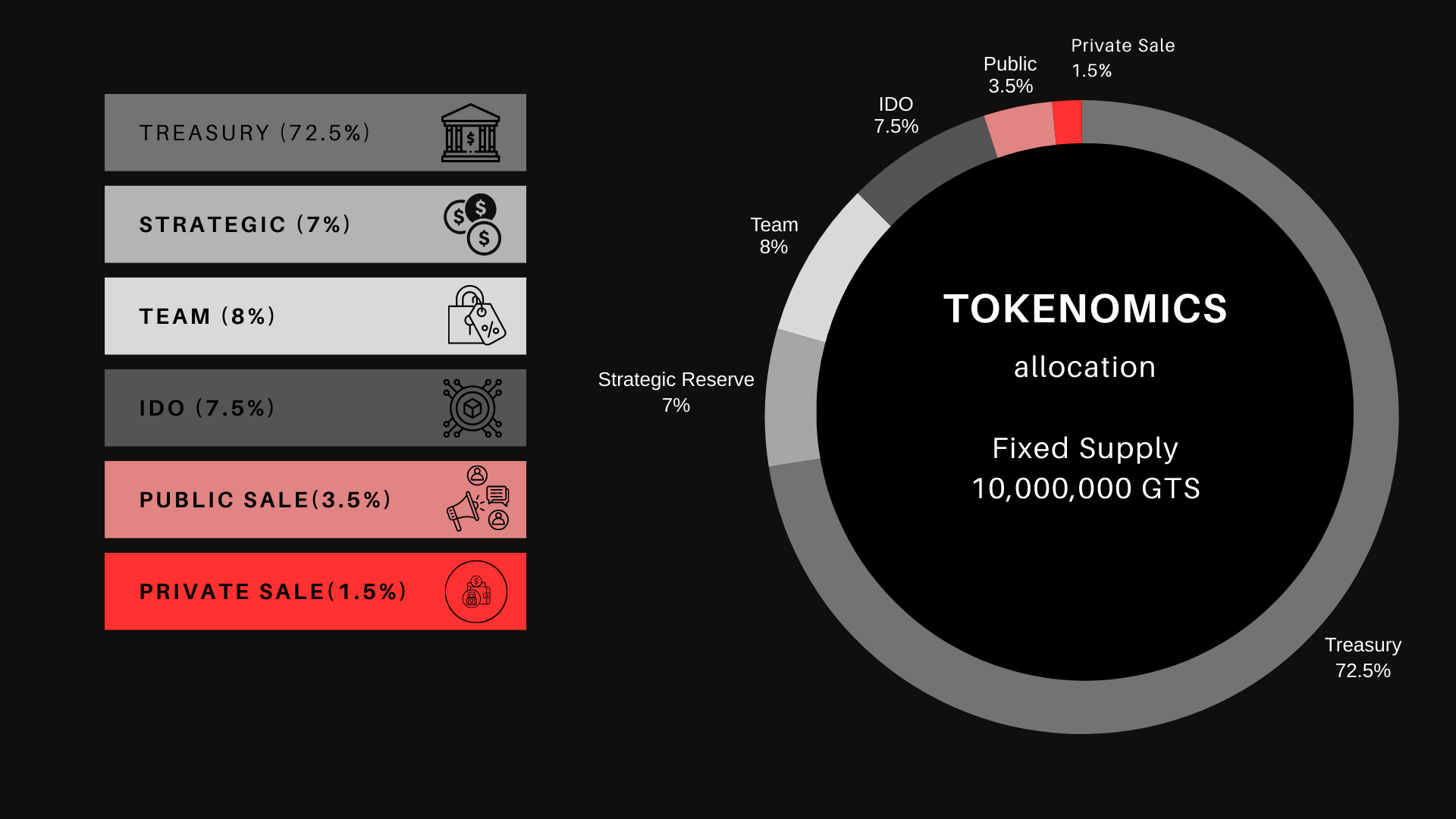

Tokenomics

Fixed supply, allocations designed for long-term trust.

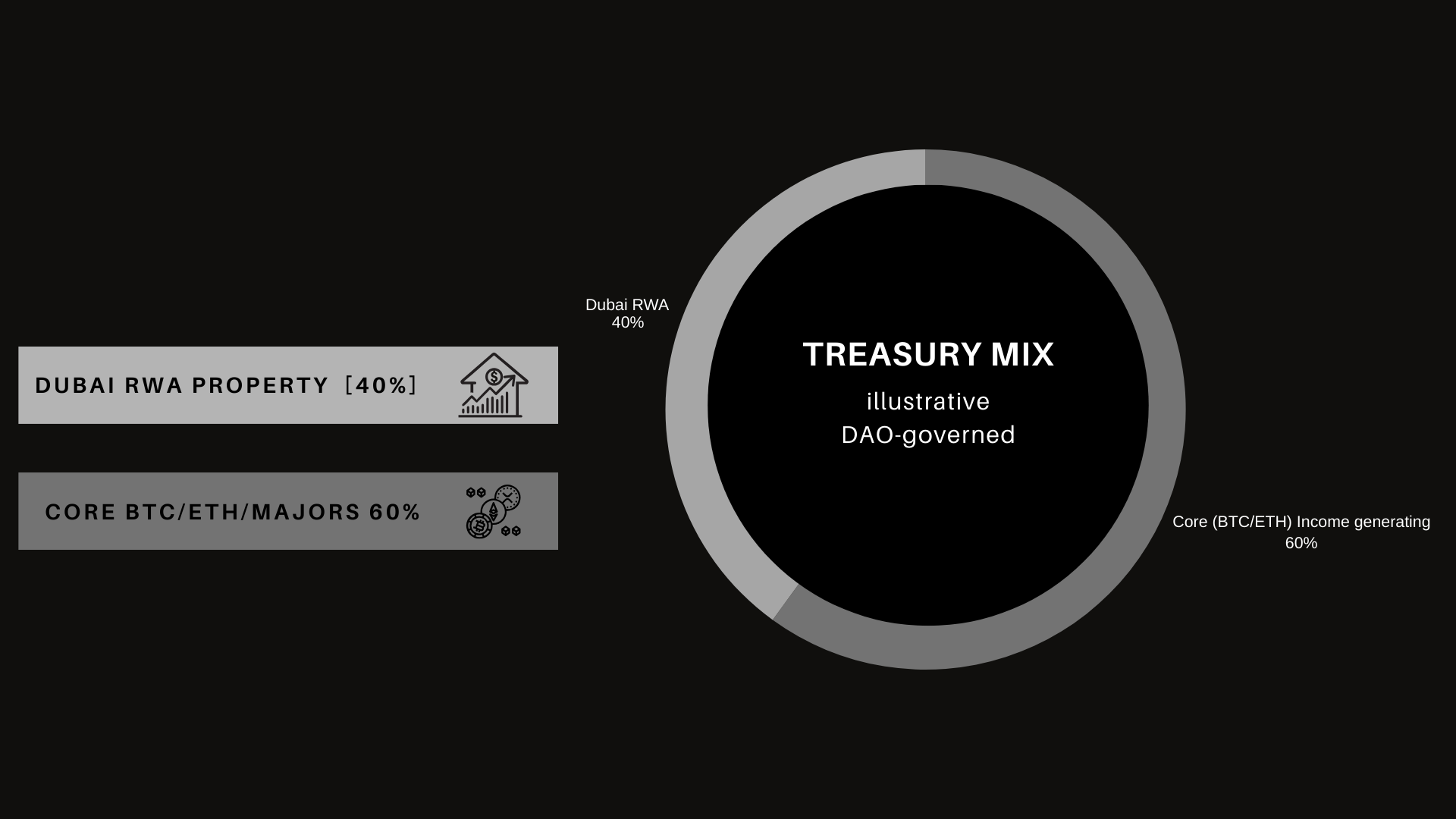

Target Treasury Mix (Illustrative)

DAO-governed blend of crypto yield and Dubai RWA. Example: 60/40 mix.

High-Level Milestones

- Private F&F ($10k–$20k)

- Public Bootstrap (Raydium $30k–$50k+)

- RAK DAO incorporation

- Ethereum IDO (Balancer $1–$3M)

- STO ($10M–$30M NAV-backed)

- Tokenized Dubai RWA — DAO Vote

- Hybrid Treasury: Crypto + RWA

- Institutional gateway for family offices

Participation & Vesting

- 20% unlock at TGE

- 80% linear vesting over 12 months

- Funds seed Raydium LP at $0.01 + initial treasury yield

Disclaimer

This is a high-risk early-stage token launch. Tokens are not equity and carry no legal claim until STO migration. Only invest what you can afford to lose.